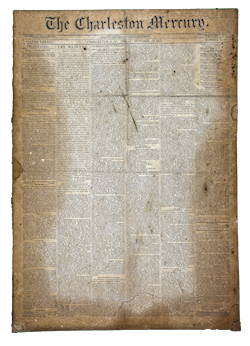

April 11, 1861; The Charleston Mercury

We publish this morning a notice from the Secretary of the Treasury of the plan by which he proposes to insure the prompt payment of the Bonds issued to raise the Confederate States Loan. The export duty of one-eighth of a cent per pound upon Cotton, imposed to meet the annually accruing interest, will exceed this requirement by a million of dollars each year, at the minimum estimate of its proceeds. This surplus the Secretary appropriates to the purchase of the Bonds from holders. By this process two objects will be secured: First, all doubt about the promptness and certainty of payment will be removed, as a fund will be always ready to redeem the Bonds in full before they mature. Second, the Government will enter and remain in the market as a bidder for the purchase of its own securities. Competition will be thereby enhanced, and the marketable price of the Bonds augmented. Thus, whether they are intended as bona fide and profitable investments for capital, or bought only for speculation, their value will be greatly enhanced by the establishment of this Sinking Fund. Never was a loan fortified by as many advantages, intrinsic and accidental. The rate of interest, the promptness of payment, and the certainty of a large demand for them, unite to make these Bonds the most desirable investment ever offered by individuals, corporations, or government authority.